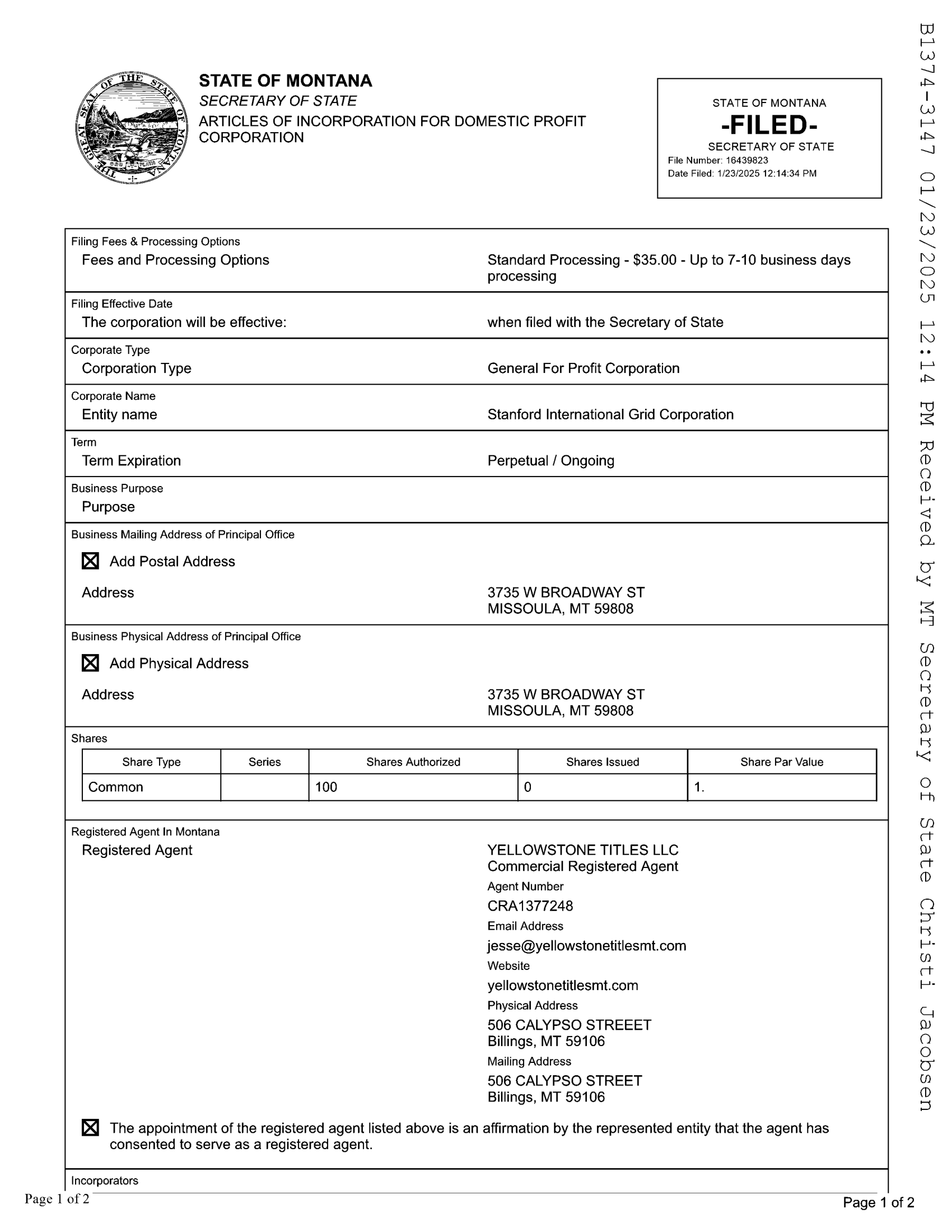

The founding team, composed of senior financial professionals and technology experts, established Stanford in California

Started developing the first AI-driven quantitative trading strategy

Conducted multiple internal tests and optimizations to ensure the effectiveness and stability of quantitative trading strategies

Successfully attracted the first batch of initial customers and began applying quantitative trading strategies in the real market

Introduced more advanced machine learning and data analysis technologies to further improve the performance of trading strategies

Gradually expanded the customer base and attracted more institutional investors and high-net-worth clients

Developed a variety of new quantitative trading strategies, including high-frequency trading, arbitrage strategies, etc., enriching the product line

Recruited more technical experts and quantitative analysts to enhance the company's R&D capabilities

Entered international markets, beginning operations in Europe and Asia

Implemented significant upgrades to the trading platform, improving system stability and processing speed

Introduced more advanced risk management tools to ensure the robustness of trading strategies in different market environments

Achieved significant breakthroughs in AI and machine learning technologies, enhancing the prediction accuracy of trading strategies

Formed partnerships with several well-known financial institutions and tech companies, further boosting technological and market influence

Optimized the customer service system, providing more personalized and professional services

Launched more types of financial products and services, including investment management, risk management tools, etc.

Strengthened brand development to enhance Stanford's reputation and visibility in the global quantitative trading field

Actively participated in industry conferences and academic seminars, sharing technological achievements and market experience

Continuously invested in technological innovation, developing smarter and more efficient quantitative trading algorithms

Secured a significant position in major global financial markets, becoming a leader in the quantitative trading field

Developed a five-year strategic plan, with a goal of further expanding market share and technological leadership

Achieved significant growth in customer numbers and assets under management, further expanding market influence

Established offices in major global financial centers, building an international team

Launched several social responsibility and sustainable development projects, actively giving back to society

English

English

admin@stanford.cab

admin@stanford.cab